The Only Guide for Home Warranty Claim

Wiki Article

The Best Guide To Home Warranty Claim

Table of ContentsSome Of Home Warranty ClaimThe Best Guide To Home Warranty ClaimUnknown Facts About Home Warranty ClaimSome Known Incorrect Statements About Home Warranty Claim 3 Simple Techniques For Home Warranty Claim5 Simple Techniques For Home Warranty Claim

Residence insurance policy may likewise cover medical expenditures for injuries that people received by getting on your property. A house owner pays an annual costs to their homeowner's insurance provider. Usually, this is someplace between $300-$1,000 a year, depending upon the policy. When something is harmed by a catastrophe that is covered under the house insurance policy, a house owner will call their residence insurance company to sue.

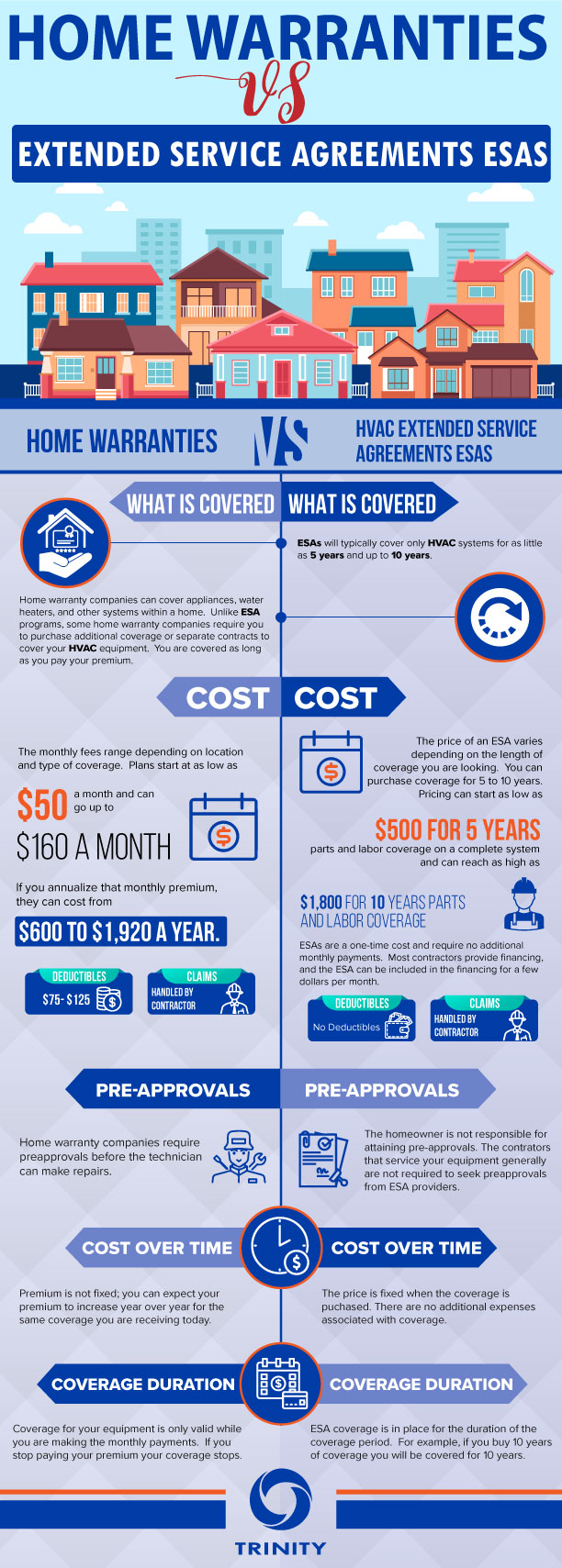

What is the Difference Between Home Warranty and also Home Insurance Coverage A home warranty agreement as well as a home insurance coverage operate in similar means. Both have an annual costs as well as an insurance deductible, although a home insurance costs as well as deductible is often much more than a home warranty's (home warranty claim). The major distinctions in between house warranties and also house insurance coverage are what they cover.

The 8-Minute Rule for Home Warranty Claim

One more distinction in between a house guarantee as well as home insurance is that residence insurance policy is usually needed for property owners (if they have a home loan on their residence) while a house warranty strategy is not required. A house guarantee as well as residence insurance coverage provide security on various components of a residence, and also with each other they can secure a house owner's budget plan from pricey repairs when they certainly surface.If there is damages done to the framework of your house, the proprietor won't have to pay the high expenses to fix it if they have home insurance. If the damages to the house's framework or property owner's belongings was brought about by a malfunctioning home appliances or systems, a home warranty can aid to cover the pricey fixings or substitute if the system or device has failed from regular wear and tear.

They will certainly interact to give protection on every component of your home. If you have an interest in buying a house guarantee for your residence, take a look at Site's home guarantee plans as well as prices below, or demand a quote for your home right here.

Home Warranty Claim for Dummies

In a warm vendor's market where house buyers are forgoing the home inspection backup, acquiring a house service warranty could be a balm for fret about prospective unknowns. To get the most out of a house warranty, it is essential to check out the small print so you understand what's covered and also how the plan works prior to registering.The difference is that a house warranty covers an array of products rather than just one. There are 3 typical kinds of home guarantee strategies.

Home Warranty Claim - The Facts

Contractor service warranties typically do not cover appliances, though in a brand brand-new home with brand name brand-new appliances, suppliers' guarantees are likely still in play. If you're getting a home warranty for a new residence either new building and construction or a house that's brand-new to you protection normally begins when you close.Simply put, if you're purchasing a residence as well as an issue turns up during the home examination or is kept in mind in the seller's disclosures, your home warranty company may not cover it. Instead of relying only on a service warranty, try to work out with the seller to either fix the concern or provide you a credit history to aid cover the price of having it taken care of.

You don't need to research and next also obtain referrals to discover a tradesperson every single time you require something fixed. The flip side of that is that you'll get whomever the home warranty firm sends to do the evaluation as well as make the repair work. You can't choose a specialist (or do the job on your own) as well as then get reimbursed.

Home Warranty Claim - The Facts

house insurance, A residence guarantee is not the exact same as homeowners insurance coverage. For one, house owners insurance coverage is needed by lending institutions in order to get a home loan, while a house warranty is totally optional. The larger distinctions are in what they cover as well as just how they function. As stated above, a residence warranty covers the repair service and also replacement of items and also systems in your house.Your property owners insurance, on the various other hand, covers the unanticipated. It won't help you change your appliances due to the fact that they got visit this site right here old, yet property owners insurance can aid you obtain brand-new appliances if your existing ones are damaged in a fire or flooding.

Exactly how a lot does a residence warranty expense? Residence warranties usually set you back in between $300 and $600 per year; the expense will vary depending look here on the type of plan you have.

Fascination About Home Warranty Claim

Report this wiki page